Pvm Accounting Fundamentals Explained

Pvm Accounting Fundamentals Explained

Blog Article

Our Pvm Accounting PDFs

Table of ContentsThe 25-Second Trick For Pvm AccountingThe Basic Principles Of Pvm Accounting Pvm Accounting Fundamentals ExplainedNot known Facts About Pvm Accounting10 Simple Techniques For Pvm AccountingIndicators on Pvm Accounting You Need To Know

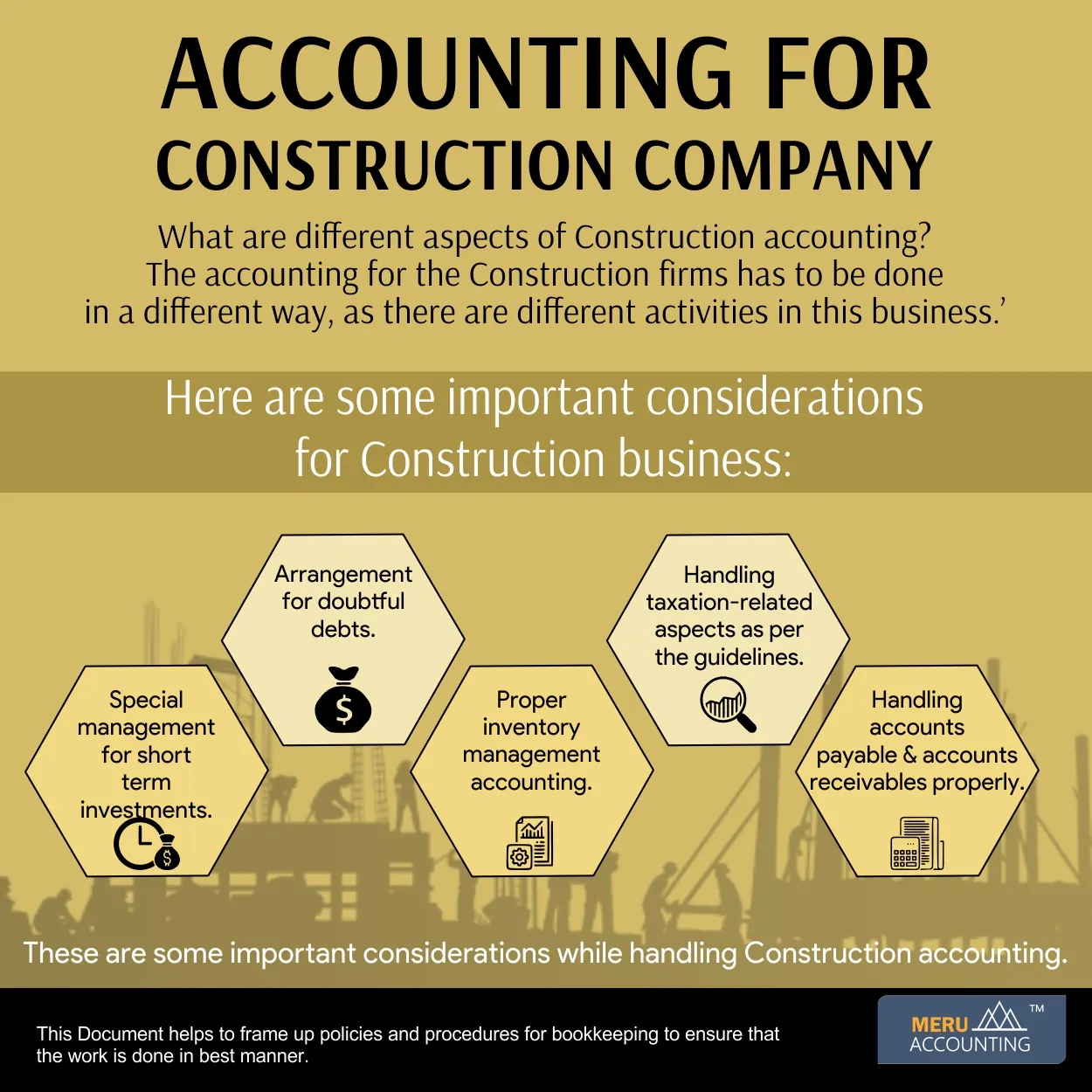

Make certain that the accounting process conforms with the regulation. Apply called for construction bookkeeping requirements and treatments to the recording and coverage of building and construction activity.Understand and preserve typical price codes in the bookkeeping system. Interact with different financing firms (i.e. Title Firm, Escrow Company) regarding the pay application process and demands required for payment. Handle lien waiver dispensation and collection - https://www.evernote.com/shard/s508/client/snv?isnewsnv=true¬eGuid=4404e321-52ad-dbea-8eba-d5e975e5f179¬eKey=IAq1oFQVQ3PnblqtDRJ-taVHQRcX3dvb_wpCe3pFQx9ozoYePcYu7Prtow&sn=https%3A%2F%2Fwww.evernote.com%2Fshard%2Fs508%2Fsh%2F4404e321-52ad-dbea-8eba-d5e975e5f179%2FIAq1oFQVQ3PnblqtDRJ-taVHQRcX3dvb_wpCe3pFQx9ozoYePcYu7Prtow&title=The%2BUltimate%2BGuide%2Bto%2BConstruction%2BAccounting%253A%2BStreamline%2BYour%2BFinancial%2BProcesses. Display and solve financial institution issues including cost abnormalities and check differences. Aid with implementing and keeping internal monetary controls and treatments.

The above declarations are meant to explain the basic nature and degree of job being done by individuals appointed to this category. They are not to be taken as an extensive checklist of responsibilities, duties, and skills called for. Personnel may be required to carry out responsibilities outside of their normal responsibilities once in a while, as required.

Not known Facts About Pvm Accounting

You will certainly aid support the Accel group to make certain shipment of successful on time, on spending plan, jobs. Accel is seeking a Building and construction Accounting professional for the Chicago Office. The Building and construction Accounting professional carries out a variety of audit, insurance policy compliance, and task management. Works both individually and within particular divisions to preserve monetary records and make particular that all records are maintained current.

Principal tasks consist of, however are not restricted to, dealing with all accounting features of the company in a prompt and accurate way and providing records and schedules to the business's CPA Firm in the prep work of all financial declarations. Ensures that all accountancy procedures and functions are managed properly. Responsible for all economic documents, payroll, financial and daily operation of the audit function.

Works with Project Managers to prepare and post all regular monthly billings. Creates monthly Job Cost to Date reports and functioning with PMs to integrate with Job Managers' spending plans for each task.

Pvm Accounting Fundamentals Explained

Efficiency in Sage 300 Building and Realty (previously Sage Timberline Office) and Procore building and construction administration software a plus. https://gravatar.com/leonelcenteno. Have to likewise be competent in various other computer software program systems for the preparation of reports, spread sheets and other audit analysis that might be needed by monitoring. construction bookkeeping. Have to possess solid business skills and capacity to prioritize

They are the monetary custodians that guarantee that building and construction jobs continue to be on budget, follow tax guidelines, and maintain monetary openness. Construction accountants are not simply number crunchers; they are tactical companions in the building and construction process. Their main duty is to manage the monetary facets of building and construction projects, making sure that sources are allocated effectively and monetary threats are minimized.

The Of Pvm Accounting

By preserving a limited hold on project financial resources, accountants help avoid overspending and economic obstacles. Budgeting is a foundation of successful building and construction jobs, and building accountants are crucial in this regard.

Navigating the facility web of tax obligation guidelines in the construction sector can be difficult. Construction accounting professionals are skilled in these regulations and make sure that the project abides with all tax needs. This includes handling payroll tax obligations, sales taxes, and any kind of other tax obligation responsibilities specific to building and construction. To stand out in the role of a construction accountant, people require a solid academic structure in audit and financing.

In addition, qualifications such as Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Sector Financial Specialist (CCIFP) are very pertained to in the sector. Building and construction tasks commonly entail limited due dates, altering policies, and unexpected expenses.

The Buzz on Pvm Accounting

Expert accreditations like certified public accountant or CCIFP are additionally very advised to show proficiency in building accountancy. Ans: Building accountants produce and keep an eye on budget plans, determining cost-saving chances and making sure that the job stays within budget plan. They also track expenses and forecast economic demands to protect against overspending. Ans: Yes, building and construction accounting professionals handle tax compliance for construction tasks.

Intro to Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar read 22, 2024 Building and construction business have to make tough options among lots of financial choices, like bidding process on one project over an additional, choosing financing for products or equipment, or setting a job's earnings margin. Building is an infamously unstable sector with a high failure price, slow time to settlement, and inconsistent cash money flow.

Production entails repeated procedures with quickly recognizable expenses. Production needs different procedures, materials, and devices with varying prices. Each project takes area in a new area with varying website conditions and one-of-a-kind difficulties.

The 9-Minute Rule for Pvm Accounting

Lasting partnerships with suppliers relieve settlements and boost efficiency. Inconsistent. Regular usage of different specialty specialists and distributors affects effectiveness and money circulation. No retainage. Payment arrives completely or with normal repayments for the complete agreement quantity. Retainage. Some section of payment may be held back till job conclusion also when the professional's work is completed.

Routine production and short-term agreements bring about convenient cash money circulation cycles. Irregular. Retainage, sluggish payments, and high upfront costs bring about long, uneven capital cycles - construction taxes. While standard makers have the advantage of controlled settings and maximized production processes, building companies must constantly adapt per brand-new task. Even rather repeatable projects call for adjustments as a result of site conditions and various other aspects.

Report this page